Disclaimer: In Real Life is a platform for everyday people to share their experiences and voices. All articles are personal stories and do not necessarily echo In Real Life’s sentiments.

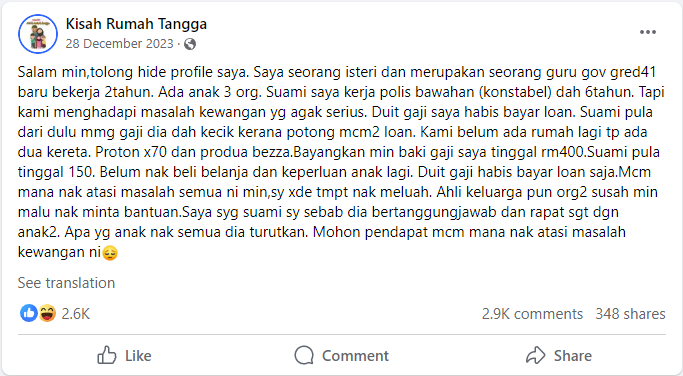

In a recent Facebook post, a Malaysian couple shared how they are unable to make ends meet despite working two full-time jobs.

The wife is a government teacher of grade 41 with two years of experience, and her husband is a constable in the police force with six years of service.

Saddled with loans and minimal disposable income, this family of five, including three children, face daily struggles despite owning two cars – a Proton X70 and a Perodua Bezza. With most of their earnings directed towards loan repayments, they barely have enough to cover necessities.

It’s a story that many of us can relate to, especially in these challenging times. What can we learn from their situation?

Owning two cars can be more of a liability than a convenience. This isn’t just about the car’s price tag; it’s about being fully prepared for all the related expenses, such as insurance, taxes, and repair fees.

How Much Should You Save Before Getting a Car?

Before diving into the dream of owning a car, figuring out how much you need to save is crucial.

For anyone considering a car purchase, here’s a useful tip to determine its affordability: Divide the car’s price by 12 (representing the 12 months in a year).

For example, if the Proton X70 Premium is priced at RM128,800, the calculation would be:

RM128,800 / 12 = RM10,733.33 per month.

This means that if you’re earning at least RM10k a month, you can afford and maintain the car comfortably.

However, if your income is less than this, even though you might manage the monthly payments, you’ll likely have very little left over each month.

In emergencies or unforeseen expenses (like car accidents), you wouldn’t have any extra money for these additional costs.

This simple calculation can be a real eye-opener, helping you to understand the long-term financial commitment of owning a car and whether it’s a wise choice based on your earnings.

#1. Set up one year’s worth of emergency funds

Most advice says you need at least 3-6 months of savings to establish an emergency fund.

Personally, I think 6 months of living expenses is not enough. We should aim for at least ONE year’s worth of expenses to provide a solid financial buffer against unexpected situations.

This level of preparedness offers a greater sense of security. It’s a foundational aspect of responsible financial management, safeguarding your future while allowing you to make major financial decisions with confidence.

#2. Save up 20% of the car’s total cost

Going for payment schemes that don’t require a down payment sounds convenient and easy, but in reality it is a trap. It’s best if you can save at least 20% of the car’s total cost as its down payment.

Having more money upfront helps you borrow less and pay less interest. For example, if you’re thinking of buying a car in the RM40,000 to RM60,000 range, you’ll need to save up RM8000 – RM12,000 as down payment. This is in addition to your 1 year of emergency funds, by the way!

It’s a smart way to start without a lot of debt.

#3. Monthly car installments should be 20% of your take-home pay

Look at your monthly money plan. Is a car payment something you can pay every month without making your money situation too tight?

A good rule is that the car payment should be no more than 15-20% of the money you bring home each month.

For example, if you’re earning, RM3500, your take home pay is around RM3000. And 20% of that amount is RM600. Anything above that is out of your budget.

That means that you ought to buy a car with a monthly repayment plan of RM600 and below.

#4. Avoid taking on further loans

One key rule is to avoid taking on new loans, especially for things that aren’t essential. It’s tempting to borrow money for immediate desires or wants, but this can often lead to a deeper debt trap.

Instead, focusing on paying off existing debts should be the priority. Each loan carries interest and additional fees, and taking on more can compound financial strain. This approach requires discipline and a shift in mindset. It involves distinguishing between what you need and what you want. It’s about creating a foundation to build wealth, not just managing debts.

By resisting the urge to take on new debts for non-essential items or services, you will safeguard your financial future. Once you achieve a more stable financial position, you can consider loans for essential or significant investments, but only if they align with your long-term financial goals.

Financial literacy is the key to financial freedom.

As we reflect on the journey of this Malaysian couple and the various strategies we’ve discussed, it becomes clear that financial management is not just about having a good salary; it’s about having financial literacy.

Financial literacy is not just about making ends meet; it’s about making informed decisions that lead to long-term financial health and independence.

By taking the initiative to learn about key topics like budgeting, saving, and investing, you will be empowered to take control of your financial future.

What do you think of this story?

Let us know in the comments!

Submit your story to ym.efillaerni@olleh and you may be featured on In Real Life Malaysia.

Read also: How I Lost My Life Savings of RM300,000 After Investing in Triumph FX Scheme

How I Lost My Life Savings of RM300,000 After Investing In Triumph FX Scheme

More from Real Relationships

‘How My Mother-In-Law Ruined My Proposal’ Shares 30 YO M’sian Woman

This is a story about a woman whose proposal was ruined by her future mother-in-law when she announced in front …

“I Had Affairs with Refugee Men” shares 59 year old M’sian woman

This story is about a woman who didn’t go looking for betrayal, she slipped into it through loneliness, silence, and …

I don’t feel anything about his death,’ shares M’sian betrayed by best friend

This story is about a man who learns that the childhood friend who once stole his happiness is now dying, …